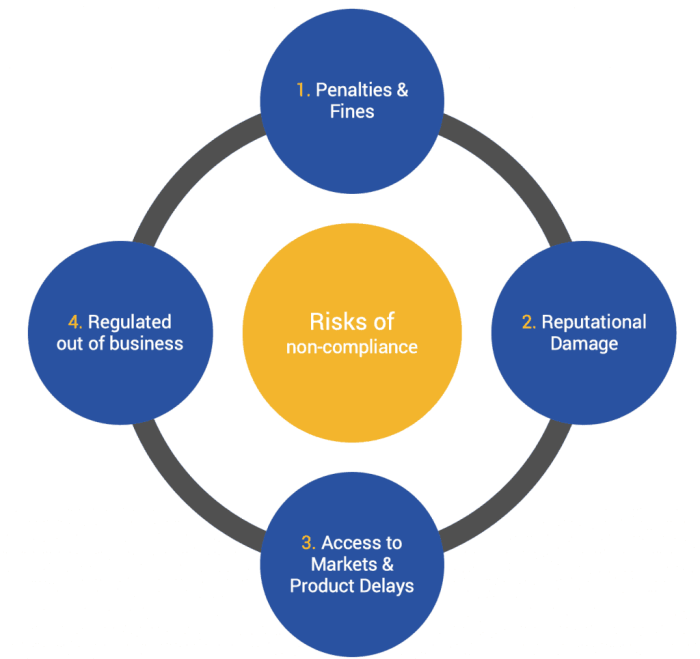

Navigating the complex world of legal compliance can be daunting for businesses of all sizes. Failure to meet regulatory requirements can result in significant financial penalties, reputational damage, and even legal action. This guide provides a practical framework for understanding, implementing, and adapting your legal compliance strategy to minimize risk and ensure long-term sustainability.

We’ll explore various types of legal compliance, including data privacy, employment law, and environmental regulations, detailing the potential consequences of non-compliance. We’ll then delve into practical strategies for building a robust compliance program, encompassing audits, documentation, software utilization, employee training, and proactive adaptation to evolving legal landscapes. The goal is to empower businesses to not just meet minimum requirements but to build a culture of compliance that fosters ethical conduct and protects their interests.

Understanding Legal Compliance Requirements

Legal compliance is crucial for any business, regardless of size or industry. Failure to comply can lead to significant financial penalties, reputational damage, and even legal action. Understanding the various legal requirements and implementing effective compliance strategies is essential for long-term sustainability and success.

Types of Legal Compliance Relevant to Businesses

Businesses face a diverse range of legal compliance obligations. These can be broadly categorized into areas like data privacy, employment law, environmental regulations, consumer protection, and tax law. Each area has its own specific set of rules and regulations that must be followed meticulously. For example, data privacy regulations like GDPR in Europe and CCPA in California dictate how businesses collect, store, and use personal data.

Employment law covers aspects such as minimum wage, working conditions, and non-discrimination. Environmental regulations address issues like pollution control and waste management. Non-compliance in any of these areas can result in severe consequences.

Penalties for Non-Compliance

The penalties for non-compliance vary widely depending on the specific regulation violated and the severity of the infraction. Data privacy violations can result in hefty fines, ranging from thousands to millions of dollars, depending on the jurisdiction and the nature of the breach. Employment law violations can lead to lawsuits, back pay obligations, and reputational damage. Environmental violations can result in significant fines, cleanup costs, and even criminal charges.

Tax non-compliance can lead to penalties, interest charges, and even criminal prosecution. The potential costs of non-compliance far outweigh the costs of implementing robust compliance programs.

Conducting a Legal Compliance Audit for a Small Business

A legal compliance audit is a systematic process of reviewing a business’s practices to ensure they adhere to all applicable laws and regulations. For a hypothetical small business, such as a bakery, a step-by-step guide might look like this:

- Identify Applicable Laws and Regulations: Determine which laws and regulations apply to the bakery’s operations, including food safety regulations, employment laws, and local business licensing requirements.

- Document Current Practices: Document all the bakery’s processes, including ingredient sourcing, employee hiring and management, waste disposal, and customer data handling.

- Compare Practices to Requirements: Compare the documented practices against the identified legal requirements to identify any gaps or areas of non-compliance.

- Develop a Remediation Plan: Create a plan to address any identified non-compliance issues, including timelines and responsible parties.

- Implement and Monitor: Implement the remediation plan and regularly monitor compliance to ensure ongoing adherence to legal requirements.

Comparison of Compliance Requirements Across Industries

The following table compares compliance requirements across three different industries: healthcare, finance, and manufacturing.

| Industry | Regulation Type | Key Requirements | Penalty for Non-Compliance |

|---|---|---|---|

| Healthcare | HIPAA | Protecting patient health information (PHI) through security measures and privacy practices. | Fines up to $1.5 million per year, criminal charges. |

| Finance | SOX | Maintaining accurate financial records, internal controls, and corporate governance. | Fines, imprisonment, delisting from stock exchanges. |

| Manufacturing | OSHA | Providing a safe and healthy workplace, adhering to safety standards and reporting requirements. | Fines, citations, potential shutdown of operations. |

Implementing Effective Compliance Strategies

Successfully navigating the legal landscape requires more than simply understanding the rules; it demands a proactive and well-structured approach to compliance. A robust compliance program isn’t just about avoiding penalties; it’s about building a culture of ethical conduct and responsible business practices that fosters trust with stakeholders and enhances the company’s reputation. This section Artikels key strategies for implementing an effective compliance program within a medium-sized company.

Designing a Comprehensive Compliance Program

A comprehensive compliance program for a medium-sized company needs a clearly defined structure with assigned roles and responsibilities. This should include a designated Compliance Officer, responsible for overseeing the program’s implementation and effectiveness. Other key roles might include department-specific compliance managers who are responsible for ensuring adherence within their respective areas, and a legal counsel to provide expert advice and guidance.

A detailed compliance manual, outlining procedures and expectations, is essential. Regular audits and reviews ensure the program remains effective and up-to-date. For instance, a marketing department compliance manager would ensure all advertising materials comply with advertising standards, while a human resources compliance manager would ensure adherence to employment laws. The Compliance Officer would oversee all these areas and report directly to senior management.

Best Practices for Compliance Documentation

Maintaining accurate and up-to-date compliance documentation is crucial for demonstrating due diligence. This includes policies and procedures, training materials, audit reports, and records of any incidents or investigations. A centralized, easily accessible system for storing and managing these documents is essential. Version control is vital to ensure everyone is working with the most current information. Regular reviews and updates should be scheduled to reflect changes in legislation and best practices.

For example, a company might use a document management system with version history to track changes to its anti-bribery policy, ensuring that all employees have access to the latest version.

Benefits of Compliance Management Software

Compliance management software offers significant advantages in streamlining and automating various compliance tasks. These systems can automate tasks such as policy distribution, training assignments, and audit scheduling. They also provide a centralized repository for all compliance-related documents, simplifying access and version control. Furthermore, many systems offer features such as automated alerts for upcoming compliance deadlines and reporting tools to track progress and identify areas needing improvement.

Using such software reduces the risk of human error and improves efficiency, allowing compliance teams to focus on strategic initiatives rather than administrative tasks. For example, the software could automatically remind employees to complete annual anti-harassment training, reducing the burden on HR staff.

Resources for Legal Compliance

Access to relevant resources is critical for maintaining effective compliance. Internal resources might include a dedicated compliance team, legal counsel, and internal audit functions. External resources include government agencies (such as the Equal Employment Opportunity Commission or the Environmental Protection Agency), professional organizations (like the American Bar Association), and legal consulting firms specializing in compliance. Staying informed about legal updates through subscriptions to relevant newsletters and journals is also vital.

Utilizing these resources ensures the company stays abreast of evolving legal requirements and best practices. For instance, subscribing to regulatory updates from the Securities and Exchange Commission can help a publicly traded company ensure its financial reporting is compliant.

Integrating Compliance Training

Compliance training should be a core component of both employee onboarding and ongoing professional development. New employees should receive comprehensive training on relevant compliance policies and procedures as part of their induction. Ongoing training should reinforce these policies and address new regulations or best practices. This training can be delivered through various methods, including online modules, workshops, and in-person sessions.

Regular quizzes and assessments can help ensure employees understand and retain the information. Tracking employee completion rates and addressing any knowledge gaps are also critical. For example, a company could integrate compliance training modules into its learning management system, making it accessible to all employees and tracking their progress.

Adapting to Changing Legal Landscapes

The legal landscape is constantly evolving, presenting significant challenges for businesses striving to maintain compliance. New regulations, court decisions, and evolving interpretations of existing laws necessitate a proactive and adaptable approach to legal compliance. Failure to adapt can lead to substantial penalties, reputational damage, and even business failure. This section explores strategies for navigating this dynamic environment effectively.The potential for legal changes impacting a company’s compliance efforts is vast and varies widely depending on industry, location, and the specific nature of the business.

For example, changes in data privacy regulations (like GDPR or CCPA updates), environmental protection laws, labor laws (minimum wage increases, changes in employee classification), and tax codes can all significantly alter a company’s compliance obligations. Furthermore, even seemingly minor changes in legal interpretation can have broad consequences.

Identifying Potential Legal Changes

Staying ahead of the curve requires a multi-pronged approach. Companies should actively monitor relevant government agencies’ websites, subscribe to legal compliance newsletters and journals, and engage legal professionals specializing in their industry. Regular internal audits and risk assessments, coupled with scenario planning to anticipate potential changes, are crucial. This proactive approach allows companies to identify potential legal changes well in advance of their implementation, providing valuable time to adjust policies and procedures.

Strategies for Proactive Adaptation

Proactive adaptation to new regulations is essential for avoiding penalties. This involves developing a robust compliance management system that includes regular updates, employee training programs, and internal audits to ensure adherence to evolving legal standards. Investing in compliance technology can also streamline the process, allowing for efficient tracking of changes and ensuring timely implementation of necessary adjustments. Furthermore, fostering a culture of compliance within the organization, where employees understand their responsibilities and the importance of adherence, is paramount.

Methods for Staying Informed

Several methods exist for staying abreast of evolving legal requirements. These include subscribing to legal databases (like LexisNexis or Westlaw), attending industry conferences and workshops, and engaging with legal professionals who specialize in compliance. Government agency websites provide direct access to official regulations and updates. However, it’s crucial to critically evaluate the information received, ensuring its reliability and relevance to the specific business operations.

Simply relying on one source may be insufficient; a diversified approach is more effective.

Examples of Successful Navigation

Many companies have successfully navigated significant legal changes. For example, following the implementation of GDPR, many companies invested heavily in updating their data privacy policies and implementing new data security measures. This proactive approach minimized the risk of penalties and enhanced their reputation for data security. Similarly, companies operating in environmentally sensitive industries have successfully adapted to new environmental regulations by investing in sustainable practices and implementing robust environmental management systems.

These examples highlight the importance of proactive planning and resource allocation in navigating legal change.

Checklist for Implementing New Regulations

When a new regulation is implemented, a structured approach is vital. This checklist Artikels key steps:

- Assess the impact: Determine the specific requirements of the new regulation and how it affects the company’s operations.

- Develop an implementation plan: Artikel the necessary steps to achieve compliance, including timelines, resource allocation, and responsible parties.

- Update policies and procedures: Revise existing documents to reflect the new requirements.

- Train employees: Ensure all relevant personnel understand the new regulations and their responsibilities.

- Implement monitoring and reporting systems: Establish mechanisms to track compliance and report on progress.

- Conduct regular audits: Regularly assess compliance to identify any gaps and address them promptly.

Final Review

Successfully navigating legal compliance is an ongoing process requiring vigilance and proactive adaptation. By implementing the strategies Artikeld in this guide – from conducting thorough audits and establishing clear roles and responsibilities to leveraging technology and fostering a culture of compliance – businesses can significantly reduce their risk of penalties and build a sustainable foundation for growth. Remember, proactive compliance isn’t just about avoiding penalties; it’s about building trust, enhancing reputation, and fostering a responsible business environment.