Protecting your business from unforeseen challenges requires a proactive and adaptable risk management strategy. This guide explores how to evolve your approach, moving beyond reactive measures to a robust system that anticipates and mitigates potential threats. We’ll delve into identifying and assessing risks, developing effective mitigation strategies, and establishing ongoing monitoring processes to ensure your business remains resilient and competitive.

From financial uncertainties to operational disruptions and strategic missteps, businesses face a complex web of potential risks. Understanding these risks, their potential impact, and the likelihood of their occurrence is the cornerstone of effective risk management. This guide provides practical tools and techniques to help you navigate this landscape, transforming your risk management from a passive exercise into a strategic advantage.

Identifying and Assessing Risks

Effective risk management is crucial for business success. Understanding and mitigating potential threats allows businesses to proactively protect their assets, reputation, and ultimately, their bottom line. This section details how to identify and assess the risks facing your business, providing a framework for developing a robust risk management strategy.

Categorization of Common Business Risks

Businesses face a wide array of risks that can be categorized for easier analysis and management. The following table Artikels common risks, their potential impact, likelihood, and suggested mitigation strategies. Note that the likelihood and impact are subjective and should be assessed based on your specific business context.

| Risk Type | Risk Description | Potential Impact | Likelihood | Mitigation Strategies |

|---|---|---|---|---|

| Financial | Cash flow problems, debt default, economic downturn | Loss of revenue, bankruptcy, inability to invest | Medium to High (depending on economic conditions and financial health) | Diversify revenue streams, secure lines of credit, develop a robust financial forecasting model |

| Operational | Supply chain disruptions, equipment failure, cybersecurity breaches | Production delays, loss of data, reputational damage | Medium (depending on preparedness and infrastructure) | Develop contingency plans, invest in robust technology, implement cybersecurity protocols |

| Strategic | Changes in market demand, increased competition, regulatory changes | Loss of market share, decreased profitability, legal penalties | Low to Medium (depending on market dynamics and adaptability) | Conduct regular market research, develop flexible business strategies, monitor regulatory changes |

| Reputational | Negative publicity, customer complaints, ethical breaches | Loss of customer trust, decreased sales, legal action | Low to Medium (depending on crisis management and public relations) | Implement strong customer service policies, proactively address negative feedback, maintain ethical business practices |

| Legal and Compliance | Breach of contract, non-compliance with regulations, intellectual property infringement | Legal fees, fines, reputational damage | Low to Medium (depending on adherence to laws and regulations) | Seek legal counsel, implement compliance programs, maintain accurate records |

Conducting a Thorough Risk Assessment

A comprehensive risk assessment involves systematically identifying and analyzing potential risks. Two valuable methods are SWOT analysis and scenario planning.

SWOT Analysis

A SWOT analysis helps identify internal strengths and weaknesses, as well as external opportunities and threats. This provides a holistic view of the business environment and highlights potential risks.

The steps involved in conducting a SWOT analysis are:

- Identify Internal Strengths: List your company’s competitive advantages, resources, and capabilities.

- Identify Internal Weaknesses: List areas where your company is vulnerable or lacking.

- Identify External Opportunities: List potential market trends, technological advancements, or other factors that could benefit your company.

- Identify External Threats: List potential risks, competitors, or other factors that could harm your company.

- Analyze the Results: Assess the interplay between strengths, weaknesses, opportunities, and threats to identify potential risks and opportunities.

Scenario Planning

Scenario planning involves developing multiple plausible future scenarios to anticipate potential risks and opportunities. This allows businesses to prepare for various outcomes and develop contingency plans.

The process for scenario planning typically includes:

- Define Key Uncertainties: Identify the major factors that could significantly impact your business.

- Develop Alternative Scenarios: Create plausible scenarios based on different combinations of these uncertainties (e.g., best-case, worst-case, and most likely scenarios).

- Assess the Impact of Each Scenario: Determine the potential impact of each scenario on your business objectives.

- Develop Contingency Plans: Develop strategies and plans to address the potential risks and opportunities identified in each scenario.

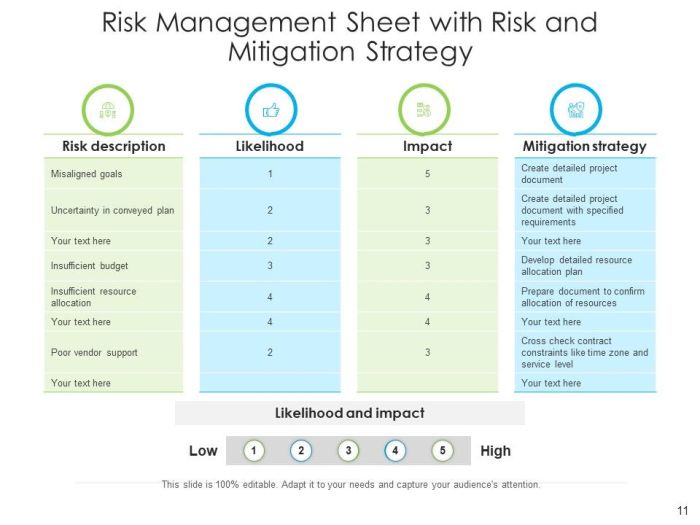

Risk Register Template

A risk register is a crucial tool for tracking and managing identified risks. The following table provides a template for creating a risk register:

| Risk ID | Risk Description | Likelihood | Impact | Assigned Owner | Mitigation Plan | Status |

|---|---|---|---|---|---|---|

| 1 | [Insert Risk Description] | [Low/Medium/High] | [Low/Medium/High] | [Name] | [Insert Mitigation Plan] | [Open/In Progress/Closed] |

| 2 | [Insert Risk Description] | [Low/Medium/High] | [Low/Medium/High] | [Name] | [Insert Mitigation Plan] | [Open/In Progress/Closed] |

Developing a Risk Mitigation Strategy

Developing a robust risk mitigation strategy is crucial for business survival and growth. It involves proactively addressing identified risks to minimize their potential impact. This strategy should be dynamic, adapting to changing circumstances and new threats. A well-defined plan will not only protect your business from significant losses but also enhance its resilience and ability to thrive in the face of adversity.Effective risk mitigation strategies vary greatly depending on the specific risk.

A one-size-fits-all approach is rarely effective. Understanding the nature and potential impact of each risk is paramount before determining the appropriate response.

Risk Mitigation Strategies for Various Business Scenarios

Several effective risk mitigation strategies can be implemented depending on the nature of the risk. For example, supply chain disruptions can be mitigated through diversification of suppliers, building strategic inventory reserves, and establishing strong relationships with key partners. Cybersecurity breaches can be prevented through robust security protocols, employee training, and regular security audits. Economic downturns can be addressed by building financial reserves, diversifying revenue streams, and focusing on cost-effective operations.

The following table illustrates examples of mitigation strategies for various risks:

| Risk | Mitigation Strategy |

|---|---|

| Supply Chain Disruptions | Diversify suppliers, build strategic inventory, strong supplier relationships, alternative sourcing options. |

| Cybersecurity Breaches | Robust security protocols (firewalls, intrusion detection systems), employee security awareness training, regular security audits, incident response plan. |

| Economic Downturns | Financial reserves, diversified revenue streams, cost reduction strategies, flexible pricing models. |

| Natural Disasters | Business continuity plan, disaster recovery plan, offsite data backups, insurance. |

| Regulatory Changes | Closely monitor regulatory developments, engage legal counsel, adapt business practices to comply with regulations. |

Risk Response Strategies: Avoidance, Mitigation, Transfer, and Acceptance

Businesses can respond to risks using four primary strategies: avoidance, mitigation, transfer, and acceptance. The optimal strategy depends on the risk’s likelihood and potential impact.

- Avoidance: This involves eliminating the risk entirely. For example, a company might choose not to enter a new market with high political instability.

- Mitigation: This reduces the likelihood or impact of a risk. Examples include implementing security measures to reduce the risk of a cyberattack or diversifying suppliers to mitigate supply chain disruptions.

- Transfer: This involves shifting the risk to a third party. Purchasing insurance is a common example of risk transfer.

- Acceptance: This involves acknowledging the risk and accepting the potential consequences. This is often used for low-probability, low-impact risks.

Implementing a Comprehensive Risk Management Plan

Implementing a comprehensive risk management plan requires a structured approach. The following steps Artikel a process for developing and implementing such a plan:

- Risk Identification: Identify all potential risks that could affect the business. This often involves brainstorming sessions, reviewing past incidents, and analyzing industry trends.

- Risk Assessment: Analyze the likelihood and potential impact of each identified risk. This may involve using qualitative or quantitative methods to assess risk severity.

- Risk Response Planning: Develop a response strategy for each risk, selecting the most appropriate approach (avoidance, mitigation, transfer, or acceptance).

- Risk Monitoring and Review: Regularly monitor the effectiveness of the risk management plan and make adjustments as needed. This includes tracking key risk indicators and conducting periodic reviews.

- Communication and Training: Communicate the risk management plan to all relevant stakeholders and provide training to employees on their roles and responsibilities.

- Documentation: Maintain comprehensive documentation of the risk management process, including risk assessments, response plans, and monitoring results.

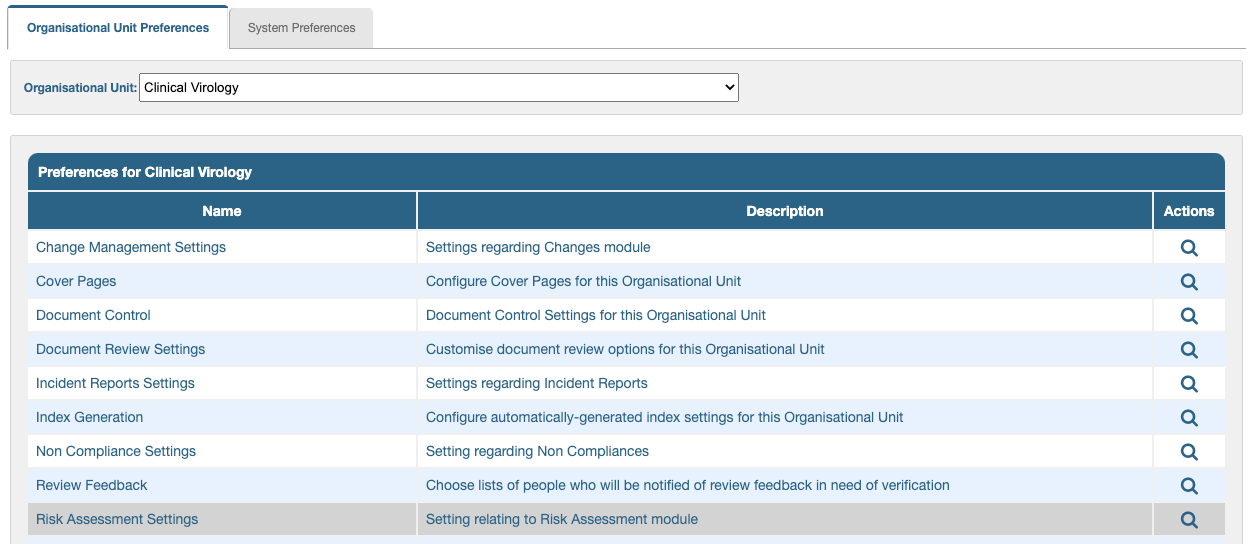

Monitoring and Reviewing Risk Management

Effective risk management isn’t a one-time event; it’s an ongoing process requiring consistent monitoring and review. Regularly assessing your risk landscape ensures your mitigation strategies remain relevant and effective, allowing for proactive adjustments to protect your business from emerging threats. Neglecting this crucial aspect can leave your organization vulnerable to unforeseen circumstances and potentially significant losses.Regular monitoring and reporting are essential for maintaining a robust risk management framework.

This involves systematically tracking identified risks, evaluating the effectiveness of implemented controls, and identifying any emerging threats or changes in the risk landscape. The frequency of reviews should align with the nature and severity of the risks involved; high-impact, high-probability risks may require more frequent monitoring (e.g., weekly or monthly), while lower-impact risks might be reviewed quarterly or annually.

Methods for conducting reviews include utilizing risk registers, conducting internal audits, soliciting feedback from employees, and leveraging data analytics to identify trends and patterns.

Risk Management Integration into Business Processes

Integrating risk management into existing business processes and decision-making frameworks is crucial for its effectiveness. This ensures that risk considerations are embedded within daily operations rather than existing as a separate, disconnected function. This can be achieved by incorporating risk assessments into project planning, incorporating risk mitigation strategies into operational procedures, and ensuring that risk discussions are a regular part of management meetings.

For example, before launching a new product, a thorough risk assessment should be conducted to identify potential market challenges, manufacturing difficulties, or regulatory hurdles. This allows the company to develop proactive mitigation strategies, such as securing alternative suppliers or developing a robust marketing plan to address potential market resistance.

Using KPIs to Track Risk Mitigation Effectiveness

Key Performance Indicators (KPIs) provide quantifiable measures of the effectiveness of risk mitigation strategies. By tracking relevant KPIs, businesses can identify areas for improvement and demonstrate the value of their risk management program to stakeholders. The selection of KPIs should be tailored to the specific risks and objectives of the organization.

| KPI | Target | Measurement Method |

|---|---|---|

| Number of critical risks mitigated | Reduce by 20% within 6 months | Track the number of critical risks identified and mitigated using the risk register. |

| Frequency of near-miss incidents | Reduce by 15% annually | Monitor near-miss incidents reported through incident reporting systems. |

| Cost of risk events | Maintain below 2% of annual revenue | Track financial losses associated with risk events and compare to annual revenue. |

| Employee satisfaction with risk management processes | Maintain an average satisfaction score of 4 out of 5 | Conduct regular employee surveys to gauge satisfaction with risk management training and processes. |

Outcome Summary

Implementing a dynamic risk management system is not a one-time event but an ongoing process of assessment, adaptation, and improvement. By consistently monitoring your risk profile, refining your mitigation strategies, and integrating risk management into your core business processes, you can significantly reduce vulnerabilities and enhance your organization’s long-term sustainability. This proactive approach ensures your business is not only protected from potential threats but also positioned for continued growth and success.